Budgets reflect priorities and demonstrate values. New Jersey legislators will have to decide whether to vote for a budget with a millionaires tax to help fund property tax relief for working families.

Across the country, millionaires are saving tens of billions from the President’s tax plan, while New Jersey’s working families are hampered by the cap of the State and Local Taxes deduction at $10,000.

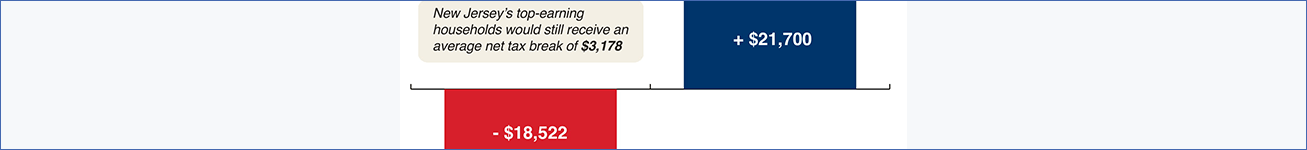

One way to address the unfairness is to extend the 10.75 percent rate down to earnings over $1 million, which currently are taxed at a rate of 8.97 percent—that is a proposed increase of less than one percent, only on income over $1 million.