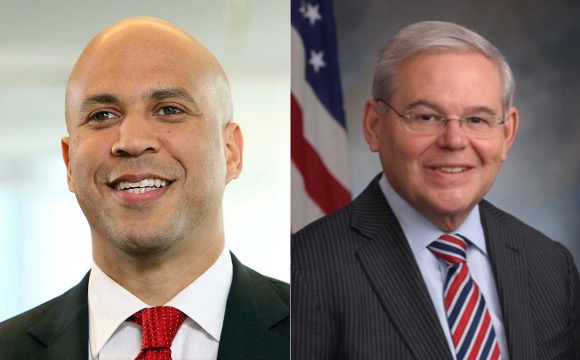

The Respect, Advancement, and Increasing Support for Educators Act of 2022 (RAISE), recently introduced by U.S. Sen. Cory Booker on behalf of himself, U.S. Sen. Robert Menendez and others, would provide all eligible early childhood and K-12 educators with a $1,000 refundable tax credit, regardless of the poverty level in the school in which they teach.

Among its other benefits, the RAISE Act would establish a refundable tax credit up to $15,000 for eligible public elementary and secondary educators and for early childhood educators who have a bachelor’s degree.

“Educators are constantly asked to do more and more without any significant increase in their compensation, and often at their own expense,” said Sen. Booker. “The COVID-19 pandemic has exacerbated these hardships, leading many teachers to leave the profession. This legislation would help support educators by using the federal tax code to put more resources back in teachers’ pockets. It’s time to reward our society’s unsung heroes by increasing teachers’ take-home pay.”

U.S. Reps. Adam Schiff, John Larson, Jahana Hayes and Mark Takano introduced companion legislation in the U.S. House.

“The popular child tax credits that so many Americans received in 2021 brought to light [the] positive financial impact tax credits can have on individuals’ and families’ lives,” said AFTNJ President Donna M. Chiera. “The [RAISE Act] also rewards districts that maintain or increase salaries with additional grants that can be used for more recruiting and retaining efforts, especially in our neediest districts.”