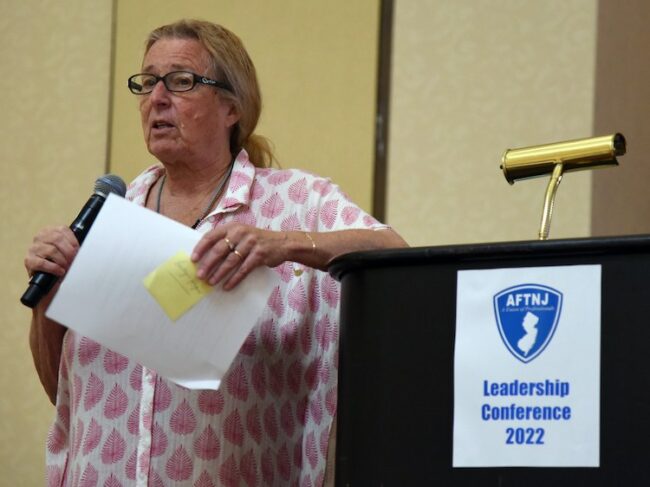

Union members were out in force Wednesday in Trenton supporting the labor State Investment Council (SIC) members and advocating for a reduction of the state’s extremely heavy investment in hedge funds. “Reducing our investment in hedge funds starts the process of keeping more pension contributions in the system, moving toward returning the neglected fund to good fiscal health,” AFTNJ president Donna M. Chiera said. “In contrast, when we overuse hedge funds, more money actually becomes profit for hedge fund managers instead of retirement security for dedicated teachers, nurses, firefighters and public workers.”

Outspoken advocacy for stable investments for pension funds at Wednesday’s meeting were a reminder for pension fund participants to vote for labor-endorsed representatives for pension trustees, Chiera said. Representatives from three of the trustee boards also sit on the SIC, which manages overall direction of the funds. “These votes occur on an annual basis within region per fund and are important in shaping the balance of power on the council,” she said. “We always make members aware when nominations and ballots are due in order to support representatives who will manage the funds responsibly.”

Labor representatives on the state’s investment council have been warning about hedge funds draining money from the already underfunded system for at least a decade, according to State Investment Council (SIC) vice chair Adam Liebtag, president of CWA 1036. Eric Richard, a SIC member and legislative coordinator for the New Jersey AFL-CIO, cited financial mogul Warren Buffet criticizing hedge funds as underperformers which money managers charge exorbitant fees to invest in.

Many AFTNJ members are participants in the Teachers Pension Annuity Fund (TPAF) or Public Employee Retirement System (PERS). A third system is for police and firefighters.

Last fall, AFT issued “All That Glitters Is Not Gold,” that evaluated the track record of 11 pension funds’ hedge fund allocation. It found that New Jersey’s hedge fund investments cost the pension fund an estimated $1.1 billion in lost investment revenue since 2007.

From 2008 to mid-2014, U.S. public pension plans invested about $450 billion in hedge funds, receiving $95 billion in returns, but paying out $68 billion in fees. That means that public pension funds paid 72 cents in fees for every dollar they received in returns, according to the Financial Times. “To add insult to injury, the 25 top hedge fund managers earn more than all kindergarten teachers in the nation,” said Chiera.

Discussion among SIC members and staff from the Treasury’s Division of Investments Wednesday acknowledged that fees paid out to hedge fund managers are excessive, an estimated $1.3 billion over the past two years alone, and they said they would look for funds with more reasonable fees, according to Chiera. “We are heartened by the discussion today and will continue to keep a sharp eye on the state’s investments to make sure member money is invested in the best possible manner.”